Contents

This is why sifting through the https://topforexnews.org/s of the market’s greatest winners is time well worth spent. Greed, fear, hope, despair and other emotions drive stock prices. TRX had a similarly Bullish ABCD BAMM Pattern on the FTX chart but that has since played out and gotten shut down. Seeking long position for about 120pips for a nice risk to reward.

IBD Videos Get https://en.forexbrokerslist.site/ updates, educational videos, webinars, and stock analysis. Chinese stocks have rebounded with Covid curbs over, but U.S.-China tensions are a concern. The handle should form in the upper part of the entire pattern. You may want to test the environment with virtual money with a Demo account.

Inverted/reverse cup and handle patterns

The trade volume should decrease along with the price during the cup and should increase rapidly near the end of the handle when the price begins to rise. If the trend is up and the cup and handle form in the middle of that trend, the buy signal has the added benefit of the overall trend. In this case, look for a strong trend heading into the cup and handle. For additional confirmation, look for the bottom of the cup to align with a longer-term support level, such as a rising trendline or moving average. Another issue has to do with the depth of the cup part of the formation. Sometimes a shallower cup can be a signal, while other times a deep cup can produce a false signal.

Make sure it doesn’t exceed the cup portion in time or size of decline. A good cup with handle should truly look like the silhouette of a nicely formed tea cup. The handle always shows a smaller decline from high to low; it represents a final shakeout of uncommitted holders, sending those shares into sturdier hands in the market. Alternatively, wait for the price to close above the resistance trend line, connecting two highs of the cup, and enter a buy trade. For this trade, a profit target will be determined by measuring the vertical distance between the bottom of the cup and the resistance trend line, connecting two highs of the cup.

What is a double cup and handle pattern?

The Cup and Handle pattern is often considered a bullish signal. However, there is also the reverse cup and handle, which represents a bearish trade. The handle alone needs at least five days to form, but it could go on for weeks.

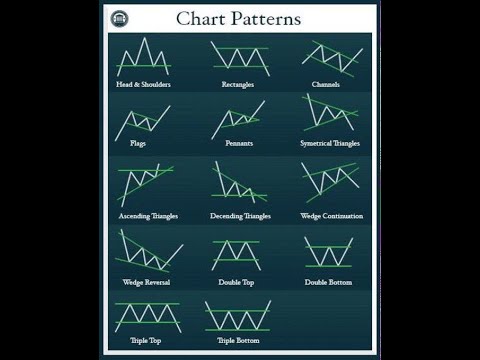

✅It is difficult to overestimate the importance of the classic continuation and reversal patterns. For a real trader trading on the Forex market, it is huge, because these patterns make it possible to predict the behaviour of the price. ⚠️If one of the trend continuation patterns appears in front of us on the chart, it means that the usual correction… Consider a scenario where a price has recently reached a high after significant momentum but has since corrected. At this point, an investor may purchase the asset, anticipating it will bounce back to previous levels. The price then rebounds, testing the previous high resistance levels, after which it falls into a sideways trend.

The pattern happens when the price of an asset is declining. Once this happens, the the cup advances and forms a U, and the price drifts downward slightly forming the handle. The price target following the breakout can be estimated by measuring the distance from the right top of the cup to the bottom of the cup and adding that number to the buy point. Determine significant support and resistance levels with the help of pivot points. For example, if a cup forms between $99 and $100, the handle should form between $100 and $99.50, ideally between $100 and $99.65. If the handle dives too deep and erases most of the gains of the cup, you should avoid trading the pattern.

The https://forex-trend.net/ Cup and Handle is the bearish version that can form after a downtrend. TradingView has a smart drawing tool that allows users to visually identify this pattern on a chart. A Cup and Handle is a chart pattern where the price movement of an asset resembles a “cup” followed by a downward trending price pattern. A cup and handle pattern derives its name from the shape it takes on the stock chart. It’s a U-shaped pattern created by a decline in stock price that bottoms-out before trading back up, ending in a period of sideways trading.

- At this point, an investor may purchase the asset, anticipating it will bounce back to previous levels.

- Learn how to trade forex in a fun and easy-to-understand format.

- After breaking above the resistance, the price skyrockets to new highs pushed by the overall bullish sentiment.

- You could also use the larger height for an aggressive target.

- At that point, it makes sense to exit the stock, even if the 7%-8% loss-cutting sell rule has not yet been triggered.

Being a continuation pattern, the inverted cup and handle pattern signals the continuation of the downtrend. The breakout from the handle’s trading range signals a continuation of the prior uptrend. Most traders set a target by adding height to the breakout point of the handle, irrespective of the cup’s height. For example, if a cup forms between $40 and $39, and the breakout point is $40, the exit strategy should be at $41. At times, the right side of the cup handle has a different height than the left. In this case, it is wise to use the smaller height and add it to the breakout point for a safer target.

Trading the cup-and-handle pattern is one technique that stems from what is known as technical analysis. But the main alternative to this type of analysis is fundamental analysis. It focuses on how the company is doing financially and operationally and can complement the insights of technical analysis. Thirdly, the price of the asset will then recover to approximately its original value.

The same goes for any pullback on price during the handle formation. Typically, a healthy cup and handle pattern has a distinctly rounded bottom. Avoid V-shaped rebounds, as they indicate reactionary buying that could nullify the formation of the handle and subsequent breakout. This is useful when trading both the cup and handle and the inverted cup and handle, because you can speculate on upward or downward price movements. This is a powerful chart pattern that’s used by stock traders to capture explosive breakout moves — where the stock price could increase 1000+% within a few years. The cup and handle pattern is a pattern that traders use to identify whether the price of an asset will continue moving upwards.

Investing Tips

A version of this column was first published in the July 9, 2010, edition of IBD. Please follow Saito-Chung on Twitter at both @SaitoChung and @IBD_DChung for more on growth stocks, charts, breakouts, sell signals, and financial markets. Round bottom with a small retracement What you would want to see on a classic cup and handle is a nice round bottom with followed by a slight retracement. Volume breakout After the formation of the cnh, the market will try to make a run, temporarily breaking the horizontal resistance. SQQQ price closing on 50.24 USD where on the breakout of resistance level 48.68 USD yesterday.

The following chart, courtesy of StockCharts.com, illustrates the pattern. Stay on top of upcoming market-moving events with our customisable economic calendar. He is the most followed trader in Singapore with more than 100,000 traders reading his blog every month… Useful guide, it’s definitely a pattern to always be watching for. You can watch the video on the pre-breakout as I believe it’ll answer your question. I’ve just come across your work – since last week’s online trading summit – and it’s outstanding.

It is a bullish continuation pattern which means that it is usually indicative of an increase in price once the pattern is complete. The pattern is a bullish continuation formation that marks a consolidation period, with the right-hand side of the pattern typically experiencing lower trading volume. The cup part of the pattern forms after a price rally and looks like a gradually rounded bottom of a bowl. The cup and handle pattern is a bullish continuation pattern triggered by consolidation after a strong upward trend.

That’s not a problem; it’s often a stock’s way of offering a buy point that’s clearer or lower than that suggested by the larger pattern. The high points of the cup and the handle are aligned on the same horizontal resistance line. This line is called the neck line of the cup with handle pattern. Remember that you should always use your knowledge and risk appetite to decide if you are going to trade based on ‘buy’ or ‘sell’ signals. The idea behind the Cup and Handle pattern is to trade the breakout when the price breaks above the “handle”. The best cup and handle patterns have a shallow retracement on the handle (not more than 1/3 of the cup).

Inverted cup and handle patterns are also possible during downtrends and signal bearish continuations. In this case, the cup shape is inverted such that it represents a resurgence in price after a downtrend followed by a downward movement. The handle slopes upwards before breaking out sharply downward to continue the original bearish trend. It’s also important to keep in mind that the cup and handle pattern is not a perfect indicator. There will be times when the stock price does not move higher after the pattern forms. In these cases, it’s important to use stop-loss orders to manage your risk and have a soundtrading strategyfor getting out.